entreprise

La qualité de la déclaration de valeur pour la police d’assurance Dommages aux Biens est devenu un élément clef du placement du risque. Face à la baisse des capacités et à l’augmentation de la sinistralité et des coûts, les assureurs ont dû durcir leurs conditions.

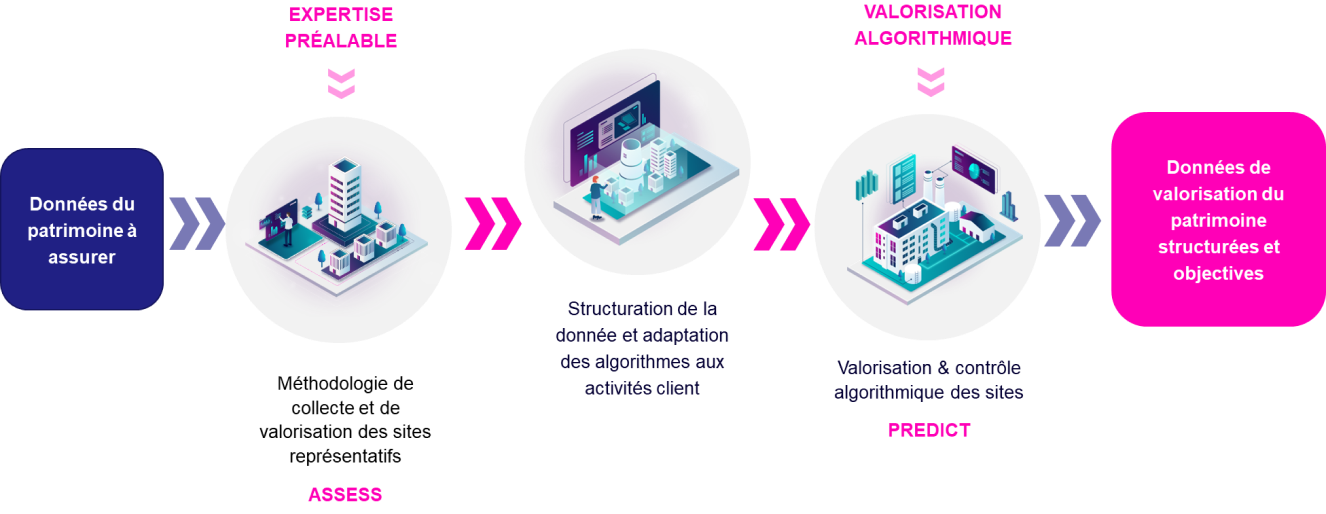

Une solution complète pour répondre aux besoins de valorisation du patrimoine d’entreprise

Pouvoir communiquer des valeurs objectives, car basées sur des éléments techniques et des valeurs comparables, car obtenues avec une méthodologie commune à tous nos experts, permet de faciliter la compréhension de la composition du patrimoine et la valeur de l’exposition aux risques.

L’utilisation des algorithmes de valorisation permet d’étendre cette précision de la valeur aux sites qui n’ont pas été visités et de prioriser les actions de valorisation dans le temps en optimisant l’investissement nécessaire.

La structuration de la donnée et le detail des caractéristiques techniques relevées par nos experts permettent au département Assurance de partager une information riche avec les départements Finance, Technique & Maintenance.